Minimum Down Payment

Minimum Down Payment

Years ago at least 20% was a required down payment for a home purchase. Those days are long gone but I still get the question asked if 20% is required by the bank. The answer is ‘No’ but putting that much down on a conventional loan does avoid you having to pay Private Mortgage Insurance also known as PMI. PMI is for the protection of the lender, not you. It protects them in case you default on the mortgage.

Today you can get a Conventional loan for as little as 3% down!

- You’ll need ‘good’ to ‘excellent’ credit

- You’ll have the ability to eliminate the PMI over time with value increases

FHA loans can be had with only 3.5% down

- They are more flexible with credit requirements

- You can carry more debt in relation to income vs a conventional loan.

VA loans do not require any down payment from the veteran

- All 3 loans will allow the seller to pay toward closing costs.

Don't hesitate to reach out with any home buying questions that come to mind!

Categories

Recent Posts

Understanding Dayton Area Home Prices: Average Sale Price By County 2024

Beavercreek, OH Real Estate Market Update: What Local Sellers Need to Know This Spring

Future Beavercreek High School = Higher Real Estate Taxes?

How to Pick the Best Local Realtor to Sell Your Home in Dayton, OH

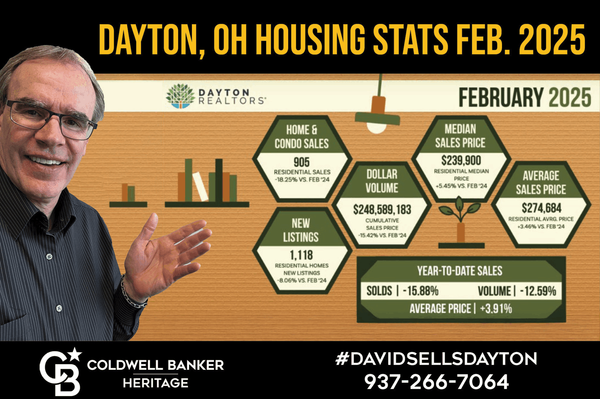

Dayton, Ohio Housing Stats Feb. 2025

What’s at Rotary Park Beavercreek, OH?

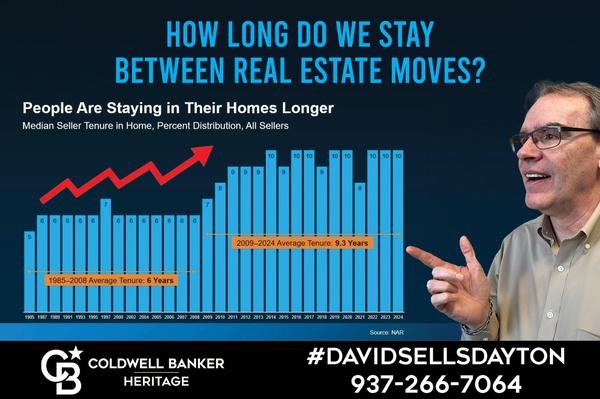

How Long do we Stay in our Homes?

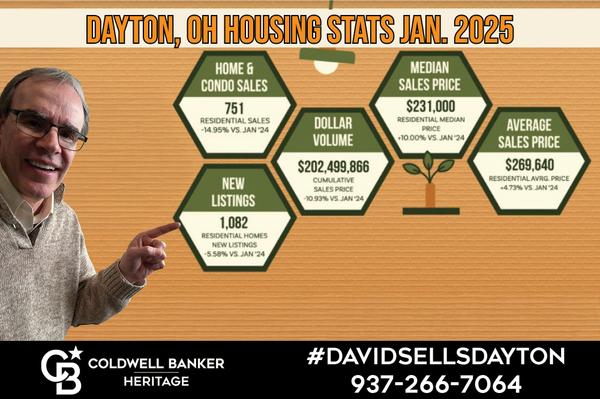

Dayton, OH Housing Stats for January 2025

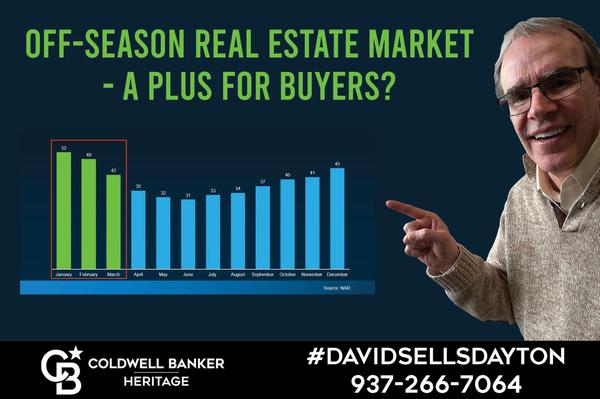

Off-Season Real Estate Market, a Plus for Buyers?

Lofino Park in Beavercreek

GET MORE INFORMATION